You could be a landlord, and you’re willing to sell your undesired residence or burdensome rental house

If you decide that selling your home doesn’t make economic sense after only one year, but you still need to have to move, you will discover other options you could investigate.

Selling a house might be tricky for very first time household sellers. You'll find worries at each individual phase, from initial valuation to ultimate negotiation. Follow these steps to navigate by means of the process seamlessly. Action 1: Improve your Control Attraction

There are various explanations why you could be taking into consideration selling your house so soon after buy. And admittedly, you’re not on your own. It’s not everything unusual for a house customer to resell their household within a year or significantly less. The truth is, it almost certainly happens much more generally than you believe.

In excess of thirty years, your curiosity fees at some point balance out, and much more of your payments go toward paying out off your house. But by selling so near when to procure the house, you are in essence just offering your cash to the financial institution for very little equity.

The something you wish to keep in mind is that the marketplace adjustments in Dallas from month to month and period to period. Our delivers may vary after a while, and our First cash supply is barely legitimate for the minimal time frame.

Also, the earnings must be ample to recoup not just the sum you put in about the house, and also your closing fees together with other charges.

Sure, It is really probable to sell a house after a person year or perhaps before that. You'll want to click this program it and understand about the possible prices. If you'd like to know tips on how to stick to these procedures so as see this page to sell a house after 1 year of invest in.

✍️ Editor's note: Some mortgages also have a prepayment penalty, meaning you'll get hit with charges for having to pay it off early. Constantly Verify your loan's stipulations!

We tend to be the no-nonsense team of money dwelling prospective buyers in Durham NC who make selling your house for cash in Durham NC hassle free.

In case you don’t fulfill all of the requirements for the exemptions stated above, the IRS has Unique policies which will permit you to assert an entire or partial exclusion – for instance career relocation, wellbeing changes, or other surprising conditions.

As an organization that gives cash for houses, working with us implies you're going to get a fair funds offer you can trust. When we obtain houses we make our greatest offer The 1st time, each and every time!

In general, we do not advise selling your house after just a year as you'll Practically undoubtedly get rid of dollars. The one exception is in case you are a seasoned house flipper who's built considerable advancements to the home or your local housing current market is viewing a tremendous spike in selling prices.

When you sell your house in advance of two years, you'll need to pay funds gains taxes with Full Report your income. If you purchased the home fewer than a year ago, you'll be taxed at your ordinary profits rate. If you wait until after a year before selling, you can expect to owe extended-expression funds gains taxes of 20% or less, based on your household income.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Meadow Walker Then & Now!

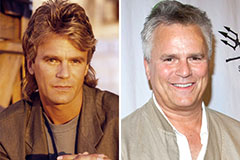

Meadow Walker Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!